Sign Up for our Newsletter!

Be sure to subscribe to our monthly BCCA Briefing to get the latest on important topics like prompt payment and compulsory trades.

In Winter 2026, the Canadian Construction Association released a report to provide an overview of the last quarter, the current economic health of the industry, and its implications for member businesses.

The Canadian Infrastructure Council’s National Infrastructure Assessment (NIA) outlines the distinct and evolving infrastructure realities across Canada. Regional pressures—from climate impacts to population growth—require planning, data, and investment tailored to local conditions. At the same time, building new infrastructure is increasingly constrained by workforce shortages, supply chain disruptions, and regulatory complexity. Despite these challenges, the NIA identifies significant opportunities to meet future needs by improving planning and asset management, strengthening operational funding, and leveraging technology, natural assets, and nature-based solutions.

SkilledTradesBC has released a new report exploring how skilled trades careers are being promoted across the province. With demand for tradespeople continuing to exceed the number of new apprentices, and more than 100,000 job openings expected in the next decade, this report highlights the collective efforts underway to raise awareness and strengthen B.C.’s skilled workforce. Drawing on insights from over 10,000 industry, community, and training stakeholders, it offers a valuable snapshot of current initiatives supporting the growth of the apprenticeship population. We’re pleased to share this resource to help amplify their important work.

Fall 2025

In Fall2025, the Canadian Construction Association released a report to provide an overview of the last quarter, the current economic health of the industry, and its implications for member businesses.

Summer 2025

In Summer 2025, the Canadian Construction Association released a report to provide an overview of the last quarter, the current economic health of the industry, and its implications for member businesses.

Spring 2025

In Spring 2025, the Canadian Construction Association released a report to provide an overview of the last quarter, the current economic health of the industry, and its implications for member businesses.

March, 2025

Detailed provincial PowerPoint presentations, including notes that describe the slides, as well as data on residential and non-residential construction investment activity, and labour supply and demand at the national, provincial and territorial levels are available for a fee on the Construction Forecasts website.

Winter 2024/2025

In Winter 2024/2025, the Canadian Construction Association released a report to provide an overview of the last quarter, the current economic health of the industry, and its implications for member businesses.

Fall 2024

In Fall 2024, the Canadian Construction Association released a report to provide an overview of the last quarter, the current economic health of the industry, and its implications for member businesses.

August 2024

In Spring 2024, the BC Construction Association conducted a survey of the 2,148 first-year apprentices hired under the Apprenticeship Services program, which closed on March 31st 2024, having injected $16.26M into BC’s economy. Discover what they had to say about their experience

AUGUST 2024

Despite a challenging economic climate marked by rising borrowing costs and market uncertainties, findings from the Canadian Construction Association’s (CCA) ICIC Construction Quarterly Insights, published in August 2024, report that construction SMEs have demonstrated remarkable resilience to maintain stability in the marketplace. Access the full report online.

MAY 2024

A companion document to the Cross-Jurisdictional Legislative Comparison of Prompt Payment and Adjudication Regimes Across Canada prepared on November 24, 2023, has been submitted to British Columbia’s Ministry of the Attorney General, Minister of Finance, and the Premier.

MARCH 1, 2024

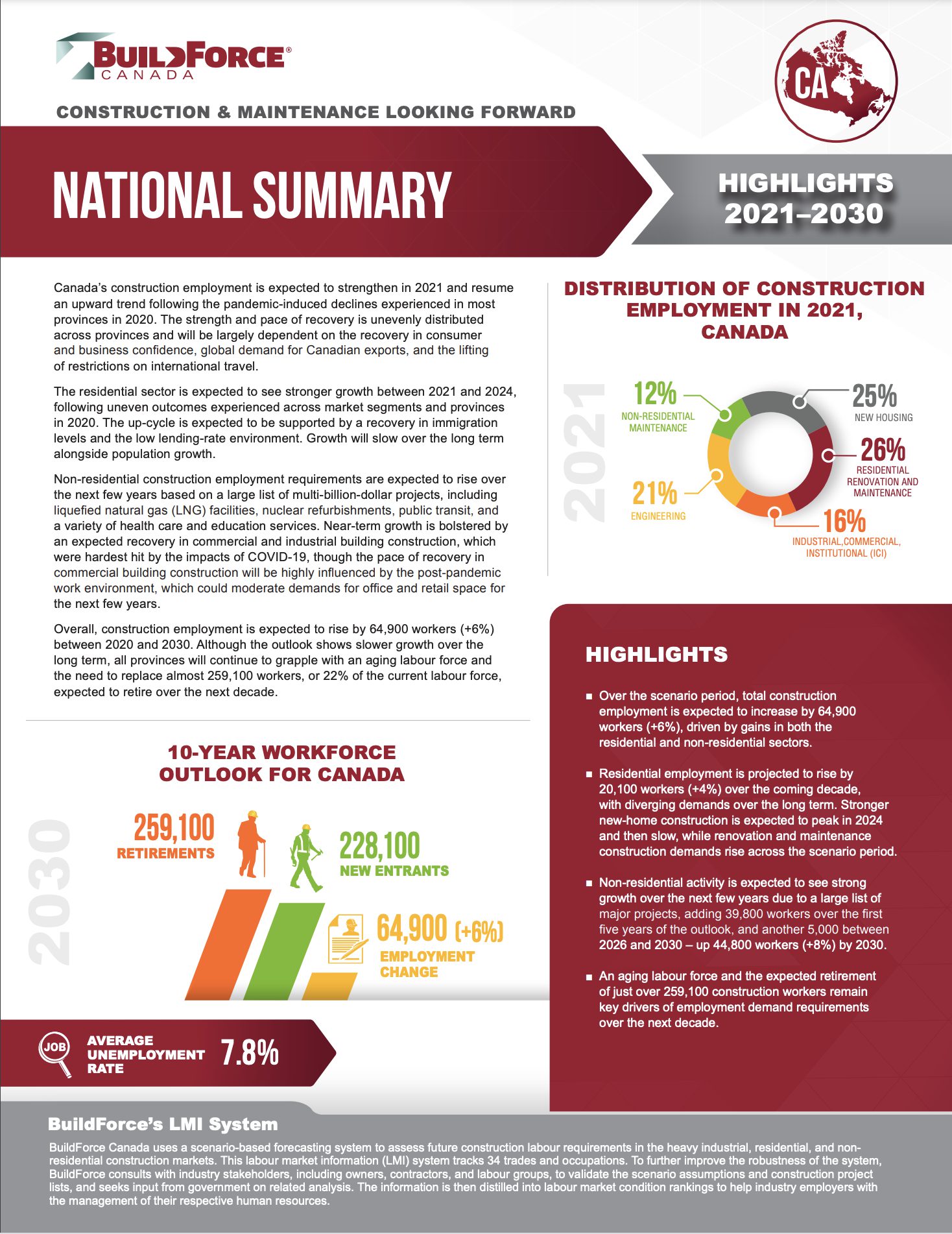

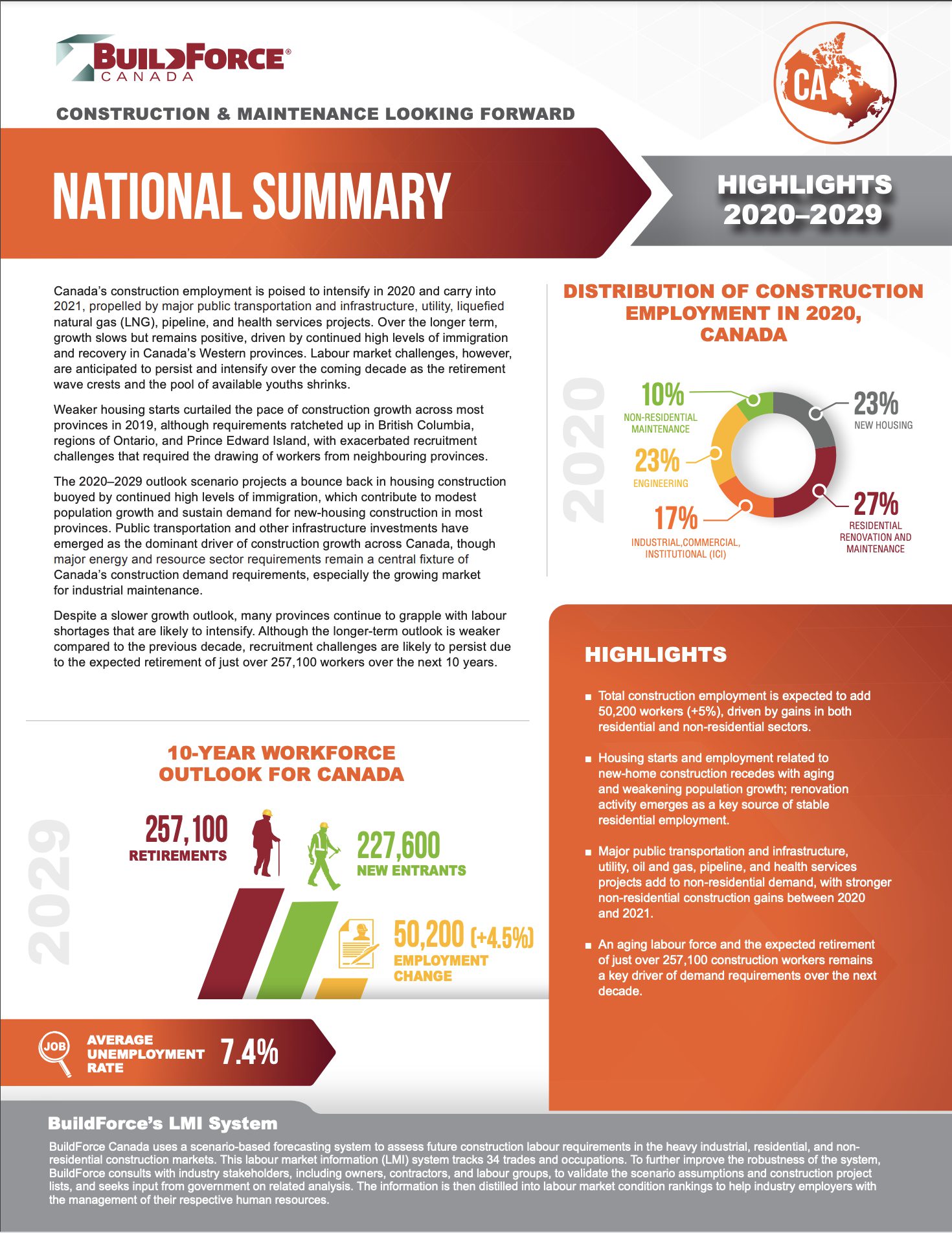

Detailed provincial PowerPoint presentations, including notes that describe the slides, as well as data on residential and non-residential construction investment activity, and labour supply and demand at the national, provincial and territorial levels are available for a fee on the Construction Forecasts website.

NOVEMBER 2023

A comprehensive, comparative view of Prompt Payment Legislation across Canadian jurisdictions presented to British Columbia’s Ministry of the Attorney General, Minister of Finance, and the Premier. Developed proactively by the BCCA in response to a letter from the Attorney General’s office this past summer that a thorough cross-jurisdictional analysis would be required before moving forward on prompt payment policy development.

MARCH 1, 2023

Detailed provincial PowerPoint presentations, including notes that describe the slides, as well as data on residential and non-residential construction investment activity, and labour supply and demand at the national, provincial and territorial levels are available for a fee on the Construction Forecasts website.

MARCH 1, 2022

Detailed provincial PowerPoint presentations, including notes that describe the slides, as well as data on residential and non-residential construction investment activity, and labour supply and demand at the national, provincial and territorial levels are available for a fee on the Construction Forecasts website.

MARCH 1, 2021

Detailed provincial PowerPoint presentations, including notes that describe the slides, as well as data on residential and non-residential construction investment activity, and labour supply and demand at the national, provincial and territorial levels are available for a fee on the Construction Forecasts website.

Includes the following products:

FEBRUARY 01, 2020

Detailed provincial PowerPoint presentations, including notes that describe the slides, as well as data on residential and non-residential construction investment activity, and labour supply and demand at the national, provincial and territorial levels are available for a fee on the Construction Forecasts website.

Includes the following products:

JUNE 12, 2019

This report draws together apprenticeship trends data and projections from the Canadian System for Tracking Apprenticeship Qualifications (CANTRAQ) to provide a forward-looking assessment of demand and supply for trade certification across the top 10 Red Seal trades in Canada. National, provincial and trade-specific assessments of demand and supply projections are also provided

MARCH 05, 2018

The BCCA does not promote one project delivery method over another, but advocates for a complete understanding of all methods available to an owner. BCCA’s opinion is that the industry should proceed with caution and be aware that IPD has many challenges to our standards and practices for market fairness. We should work with public owners to advocate for the development of an education program for all the stakeholders in IPD.

OCTOBER 20, 2017

As the largest employer in BC’s goods sector, employing nearly 250,000 British Columbians who collectively earn $13 billion in wages annually and contribute 8.6% of GDP, the construction sector offers powerful economic development opportunities…

MORE

Overview

As the largest employer in BC’s goods sector, employing nearly 250,000 British Columbians who collectively earn $13 billion in wages annually and contribute 8.6% of GDP, the construction sector offers powerful economic development opportunities in communities across the province.

In particular, skilled trade jobs mean rewarding, sustainable career opportunities, with an average salary of $58,500 per year. In a sector where two thirds of the workforce is currently aged 45 or over and retirements are contributing to a predicted gap of 15,000 workers, the life-changing opportunities available to British Columbians through the construction industry are very real.

The strong provincial economy and government’s commitment to infrastructure development combine to underscore the need for a transparent and inclusive strategy for attracting and retaining skilled workers and developing sustainable businesses from all of our communities, including those of BC’s indigenous peoples.

To ensure that construction employment and project opportunities are fairly a

vailable to all British Columbians, industry and government have the responsibility to collaborate. It is essential that we share a mutual understanding of how private and public programs, policies, and other actions may influence outcomes.

Action

There are three main levers influencing the construction industry that have the potential to improve our collective ability to attract and retain an indigenous construction workforce while upholding the integrity of public sector procurement processes and the highest standards of project outcomes:

1) Community Engagement

The Canadian Construction Association partnered with Indigenous Works (formerly the Aboriginal Human Resource Council), the BCCA, and other provincial construction associations to publish a guide to assist the construction industry engage more effectively with indigenous companies and communities in Canada. The guide is available to all construction employers and can be viewed here.

At BCCA, the majority of community engagement with indigenous populations occurs in these settings:

BCCA works diligently to support the efforts of both the private and public sector in engaging with indigenous communities to source local contractors and employees for construction projects, operating as a proudly non-partisan organization working for the betterment of our communities. In general, engagement occurs on a project-by-project basis.

2) Skilled Workforce

Development Currently, we estimate approximately 5% (10,500) of BC’s construction workforce self-identifies as indigenous. Given that 4.2% of BC’s population is indigenous, this is arguably a reasonable reflection of the population as a whole. (Currently, it is estimated that between 4% and 7% of BC’s construction workforce is female.) However, accurate demographic statistics are difficult to obtain and can fluctuate significantly based on multiple factors including the seasonality and project-based hiring patterns of the construction industry.

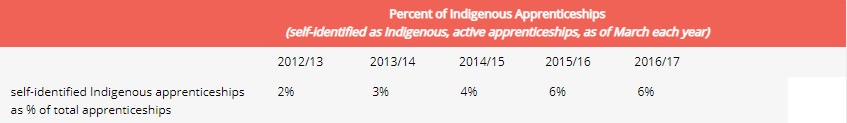

The table below is provided by the Industry Training Authority (ITA):

Note that the 2,279 Indigenous apprentices enrolled as of March 2017 are currently participating in 76 different trades training programs.

There are many valuable trades training and workforce development programs operating in BC to assist underrepresented populations in getting the training and job opportunities they need to succeed. The flagship construction program in BC is the Skilled Trades Employment Program (STEP), managed by BCCA and funded by the province since 2006. To date STEP has placed over 10,000 British Columbians on a path to a career in construction.

STEP is different from other job placement programs because it exclusively concerned with construction jobs from a “demand driven” perspective, which means that STEP kicks into gear only when a construction employer has a job to fill. STEP does not provide training but does purchase training from established providers for participants, when that training is required for a job placement. Ministry of Advanced Education and Skilled Straining eligibility requirements ensure that the majority (at least 75%) of STEP job placements are indigenous, women, youth, immigrants, or a person with a disability. STEP works with First Nations and community service providers to promote its services, making presentations to Friendship Centres, Band Offices and often working closely with job coaches. STEP employs Indigenous/Metis staff who have excellent connections in their communities.

There are many organizations, some with alternative support funding options, offering specific assistance to indigenous people. Therefore STEP doesn’t generally tend to see high participant numbers in this target group except in the North, and even those numbers have declined due to a variety of factors including the wider number and type of supports available. Also, Indigenous applicants can present with more barriers to employment and often require further education training, mentoring, employment coaching and life skills training.

The most recent data suggests that Indigenous people comprise about 24% of STEP placements outcomes.

To date, we estimate the positive financial impact of the STEP program in BC to be substantial: please refer to the overview on the following page for a detailed overview.

3) Aboriginal Business Enhancement Policy and Contract Stipulations (also known as “Set Asides”)

Most levels of government within Canada have an aspiration to improve economic development through their purchasing conduct. Often these goals include a focus on furthering the economic health of specific communities or demographics such as indigenous populations, youth, and women.

Accordingly, public owners often seek to adapt policy and processes to guarantee the participation of minority groups such as Indigenous suppliers. Recent examples in BC can be drawn from tenders for civil construction projects where preference is given to contractors who hire Aboriginal workers or who engage in Joint Ventures with Aboriginal companies.

Direction for Indigenous engagement from the courts and the inclusion of community impact assessments for projects has placed new emphasis on the demonstration of Aboriginal involvement. This policy results in a preference being introduced into the procurement process, contradicting industry policy that inclusion and diversity be embraced without compromise to fairness and transparency of process. This is essential to ensure the highest project standards.

The official BCCA policy for Minority Preferences And Set-aside Programs is:

The BC Construction Association strongly endorses the principle that neither the sex, race, religion, nor geographic domicile within the Province of the principal owners of a firm, its employees, or labour force, should be a consideration in the procurement of construction materials or services. Furthermore, the Association vigorously opposes any procurement practice or program, which seeks to confer exclusive bidding rights to firms based upon any of the foregoing characteristics.

The industry fully supports initiatives which encourage minority groups to participate in construction and construction employment and training programs. However, when construction procurement requirements in the public sector indicate preference for employment based on subjective criteria this does not reflect the fair, open, and transparent process which is the responsibility of government to all citizens.

The most productive and positive way for a public owner to encourage employment fromminority groups is to continue to support industry-led employment and business development programs. These programs reach into BC’s communities to provide the training and supports that assist underrepresented British Columbians to find, qualify for, and succeed in construction careers with integrity of process and outcome.

For example, a requirement for project proponents to demonstrate participation in a program such as STEP as part of their business operations would be a productive stipulation to meet Aboriginal inclusion or enhancement objectives, fill the skilled trades gap, and build BC’s skilled workforce.

SEPTEMBER 01, 2017

This Guide is intended to provide some basic information and is an introductory guideline for those who may be newcomers to the construction sector in British Columbia.

MORE

Note: This Guide is intended to provide some basic information and is only an introductory guideline for those who may be newcomers to the construction sector in British Columbia. BCCA takes no responsibility for the accuracy or completeness of the information provided. Professional counsel should be retained to provide comprehensive advice on doing business in British Columbia.

Licensing Requirements

Other than a Business License that may be required by a Municipality or Regional District, in which a company is working, there are no comprehensive licensing requirements for the ICI Sector in BC.

There are licensing requirements for trade contractors who fall under the requirements of the Technical Safety BC. These are for the most part only those trades that require life safety installations such as electrical, gas, and elevators.

Workers Compensation

For requirements refer to WorkSafeBC.

Other Requirements

A small sampling of other requirements that relate to construction that it may be advisable to be familiar with are:

Because of the complexity of the construction sector it may be advisable to engage the counsel of a professional. The Resource Information below provides some references for sources of professional services.

Resource Information

Construction Safety Association of BC

The BC Construction Safety Alliance (BCCSA) is a non-profit organization that is owned and operated by the construction industry of British Columbia. Its goal is to reduce the number and duration of workplace injuries and to lower contractor costs.

BCCA Member Law Firms

Many law firm members of BCCA specialize in construction law – find the Regional Construction Association nearest to you and contact them for more information.

BCCA Member Accounting Firms

Accounting firms that are members of BCCA can advise on GST (Goods and Services Tax), and other tax issues – find the Regional Construction Association nearest to you and contact them for more information.

Licensing Requirements

As well as local Business Licence requirements and Trade Contractor Safety requirements, there may be additional requirements from BC Housing. BC Housing develops, manages and administers a wide range of subsidized housing options across the province. They also license residential builders, administer owner builder authorizations and carry out research and education that benefits the residential construction industry, consumers and the affordable housing sector. Learn how to become a Licensed Residential Builder with BC Housing.

Other Requirements and Resources

Refer to the information above for the ICI Sector.

Licensing Requirements

As well as local Business Licence requirements and Trade Contractor Safety requirements, there may be additional requirements from BC Housing. BC Housing develops, manages, and administers a wide range of subsidized housing options across the province. They also license residential builders, administer owner builder authorizations and carry out research and education that benefits the residential construction industry, consumers, and the affordable housing sector. Learn how to become a Licensed Residential Builder with BC Housing.

Canadian Homebuilders Association of BC

The Canadian Home Builders’ Association of British Columbia (CHBA-BC) represents residential contractors and associated service providers in B.C.

Other Requirements and Resources

Refer to the information above for the ICI Sector.

MAY 17, 2017

The British Columbia Construction Association (BCCA) has published a follow-up to its Innovation Report (February 2016), which revealed BC’s construction sector lags behind other jurisdictions when it comes to innovation. The new report is called “Procuring Innovation in Construction” and lays out the case for the sector to recognize the procurement process as the key for driving innovative projects and sector development.

“Margins are tight and businesses have to operate profitably, yet if we don’t innovate we’re in danger of undermining our collective ability to compete. The sector has to introduce whole-life value to the process.”

JANUARY 01, 2017

Detailed provincial PowerPoint presentations, including notes that describe the slides, as well as data on residential and non-residential construction investment activity, and labour supply and demand at the national, provincial and territorial levels are available for a fee on the Construction Forecasts website.

Includes the following products:

DECEMBER 01, 2016

BCCA recognizes that corporate social responsibility (CSR) is a rapidly evolving issue and affects companies differently depending on their size, location and specialization. BCCA recognizes the importance of CSR, and encourages companies to voluntarily undertake initiatives that enable them to operate in an economically, socially and environmentally sustainable manner.

MORE

What is Corporate Social Responsibility?

A Corporate Social Responsibility code or CSR is part management tool, part promotional tool, and part decision making framework. CSRs go by many names including: corporate governance, triple bottom line, corporate responsibility, corporate citizenship and corporate ethics, to name a few. While at first glance a CSR looks only like a PR tool, incorporating a CSR into your organization can provide a real competitive advantage by streamlining your corporate decision making, increasing operational transparency, reduce risks and build on your organizations social capital. CSRs can define your organizations relationships by informing others of what your organization is about and what they can expect from you. CSRs are about relating your social and environmental performance directly to your financial performance. Developing a CSR is relatively straight forward; you decide what to include and what it will mean to your business.

Take a few minutes and ask yourself these five questions:

What are your company’s values and goals?

Decide what else affects your decision making other than your bottom line.

Who are your key stakeholders, not just your shareholders?

List all the groups who affect your decision making and are affected by your decisions.

What strengths and weakness are there in your corporate decision making process?

Look to issues that leave you saying “I don’t know.”

How do you relate your business’ goals, your organizational values and your operational practices to your financial performance?

What values and practices directly impact your bottom line?

How do your social and environmental performances affect your financial performance?

How do your hiring policies, community involvement, and environmental practices impact your bottom line?

Why should you have a CSR Statement?

CSRs can be an avenue to correcting behaviour or to making business more sustainable. CSRs are about developing Social Capital and are a valuable and real way of saying what your doing and doing what you say. They state in plain language what an organization, company, business, or corporate entity believes in and strives for. CSRs show what stakeholders can expect from you and what you expect from stakeholders. CSRs are fundamentally a strategic tool for medium to long term planning and success. Corporate Social Responsibility codes incorporate the idea of the Triple Bottom Line. The Triple Bottom Line represents equal consideration to People, the Planet and Profit; relating all three to each other and showing that each one is dependant on the other two.

Social Capital is the goal of adopting a CSR, which means strengthening the social connection and interdependencies of the public with private business through increased dialog and considerations for both sides of the relationship. Public expectation for companies to operate responsibly means business will have to be able to demonstrate and document their social and environmental activities particularly when dealing with the public sector. Contracts may be awarded to companies that have adopted a CSR over one that has not even without the requirement of having one. Being able to demonstrate and document your relationship to your community can create a real advantage. Given the choice between two similar companies, the decision may come down to who will be a greater positive influence on the project or who has a stronger connection to their community.

Who has a CSR?

Many companies have a CSR, in fact the majority of them have incorporated them as part of the core of their business. CSRs are more than just transparent operations and community involvement. CSRs can ensure the long term sustainability of a community, even after you’ve finished doing business there. Take a look at what some other companies in Canada are doing with their CSR.

FEBRUARY 18, 2016

The BC Construction Association is pleased to lead the charge on this important issue and proud to have co-funded this report. We look forward to continuing the conversation and welcome all stakeholders to join us.

“This report is an important step for BC’s sector in understanding and leading productive change for our industry.”

JANUARY 01, 2016

For the construction industry, the issue of green building will only continue to grow in importance – whether it’s because of regulatory requirements, the cost of energy going up, or the tangible effects that construction has on the natural environment.

MORE

LEED

The Leadership in Energy and Environmental Design (LEED) Green Building Rating System™ encourages and accelerates global adoption of sustainable green building and development practices through the creation and implementation of universally understood and accepted tools and performance criteria. LEED is a third-party certification program and an internationally accepted benchmark for the design, construction and operation of high performance green buildings. It provides building owners and operators the tools they need to have an immediate and measurable impact on their buildings’ performance.

Canada Green Building Council

Cascadia Chapter of Canada Green Building Council

Built Green Canada

Built Green Canada is a national, industry-driven organization committed to working with interested in responsible sustainability practices in the residential building sector. The organization offers programs for single family, high density, and renovation projects, with a communities program under development. Part of BUILT GREEN® builder member criteria is membership to a professional organization; one such example is that of a local chapter of CHBA. Built Green Canada also has both a Product Catalogue, with BUILT GREEN® Approved products, and a “Supporting Member” option, which is defined as those who are responsible for products or services for housing construction. While energy efficiency is a fundamental component of these programs, integrating the EnerGuide label through Natural Resources Canada, Built Green Canada goes beyond energy efficiency, moving the industry toward a more holistic approach to sustainable building practices. An approach that includes the preservation of natural resources, reduction of pollution, ventilation and air quality, and the improvement of home durability. As such, members and their customers get a two-in-one: the BUILT GREEN® seal and the EnerGuide label. Built Green Canada offers four levels of home certification: BUILT GREEN® Bronze, Silver, Gold, and Platinum. Committed to the integrity of its programs, Built Green Canada provides learning opportunities that allow for continuous improvements to building practices, participation affordability, and third-party certification, which requires builders to contract Energy Advisors to assess the effectiveness of the systems in the home.

BOMA BESt BOMA

BESt is the next evolution of BOMA Canada’s Go Green program. BESt stands for Building Environmental Standards, and represents the direction of the commercial real estate industry in Canada and BOMA Canada’s role in providing the mechanisms for common practices across the industry. With four possible levels of certification, users can progress through the program and continually use the framework of the Go Green Best Practices and the Go Green Plus assessment to improve environmental performance and management. The BOMA BESt certification builds on Go Green and Go Green Plus by harmonizing these separate certifications into one program.

Green Globes

The Green Globes system is a revolutionary building environmental design and management tool. It delivers an online assessment protocol, rating system and guidance for green building design, operation and management. It is interactive, flexible and affordable, and provides market recognition of a building’s environmental attributes through third-party verification.

NOVEMBER 02, 2015

A recent study involving a survey of over 1000 CEOs found that 93% of them believe that sustainability will be important for the future success of their business. These views may be based on strong evidence from studies that have contributed to strengthening the link between company performance and “doing the right thing”. However, it should not be forgotten that a moral, and in some cases legal expectation towards business to do the right thing exists independently of financial incentives.

JANUARY 01, 2015

BuildForce Canada’s annual Construction and Maintenance Looking Forward forecasts offer a 10-year scenario of workforce supply and demand by trade, province and region. These forecasts help industry, training providers and government decision makers manage workforce requirements.

Detailed provincial PowerPoint presentations, including notes that describe the slides, as well as data on residential and non-residential construction investment activity, and labour supply and demand at the national, provincial and territorial levels are available for a fee on our Construction Forecasts website.

Includes the following products:

FEBRUARY 01, 2014

Key sections are:

1 – Outcomes Orientation

2 – More Industry Leadership

3 – Accountability

4 – Access to Apprenticeship

FEBRUARY 01, 2014

Light House provides research, advisory and project management services to businesses, policy makers and the real estate and construction industries. Our projects cut across all scales of building and development, from buildings to regions, and across the residential, institutional, commercial, and industrial sectors.

JANUARY 01, 2014

On January 14, 2013, the British Columbia Construction Association (BCCA) officially published a fourteen-page review of industry concerns, providing practical recommendations to improve the planning, implementation, and operation of assets in BC’s public sector.

Fair and Transparent: Implementing the CAMF for Construction Procurement stresses the need for partnership and outlines the struggle to successfully establish reasonable standards for government, Crown corporations and publicly-funded agencies’ use in capital asset planning.

The BCCA’s recommendations for public procurement policy include:

JANUARY 01, 2014

Partnering with industry is a priority, as is access to accurate and current labour market information.

The Blueprint has three main sections:

1 – Elementary Middle and High School

2 – Post Secondary demand-driven training

3 – Industry collaboration

OCTOBER 02, 2013

Report by: Mark Anielski

Published: October 2, 2013

The objective of this assessment was to evaluate the financial well-being impacts of employment programs and initiatives administered by the British Columbia Construction Association (BCCA).

The report asks:

Assessed and expressed in terms of economic (monetary), community, employer, and personal/family (mental, physical, emotional) quality of life impacts, this report assesses the real costs – and benefits – of the BCCA’s initiatives using the Connector Model, including the Skilled Trades Employment Program (STEP), its associated programs, and the JobMatch program.

For more information visit STEPBC.ca

AUGUST 01, 2013

August 2013 marked the launch of a fully integrated online bonding protocol using industry-leading technology, and with it the completion of Canada’s most advanced online bidding solution: BidCentral.

With millions of project dollars being managed through BidCentral, meeting the highest standards of the Surety Association of Canada, as well as the business needs of owners and contractors, is vital.

In consideration of meeting these highest standards the law firm of Jenkins Marzban Logan LLP has reviewed the legal requirements of a valid and enforceable bid bond in an electronic transaction and prepared the attached paper which concludes that “there should be no legal impediment to the validity and enforceability of electronic bid bonds in British Columbia or any other jurisdiction with similar electronic transactions legislation and common law principles.”

SEPTEMBER 24, 2012

The construction sector represents the largest percentage of small businesses in British Columbia’s goods-producing sector. However, the vast majority of small business owners in the construction sector are over 50 and preparing to retire within the next ten years. Those retirements will affect more than 3600 BC construction businesses, impacting close to 9600 construction jobs throughout our province.

Business owners and industry must minimize the potential impact of lost jobs from retiring owners who simply close their doors and lay off employees because owners were unable to find a successor, combined with too few opportunities for sale and consolidation.

It is suggested that business owners considering their retirement get an early start and open the lines of communication with involved parties and experts. Developing a plan may require significant research unique to each individual and organization, discussions with staff, family and business partners, and may require input from lawyers, financial professionals, realtors, and other consultants as needed.

JANUARY 01, 2012

Addressing several issues relating to certification, insurance, ongoing cases and challenges, and a variety of trends, the paper provided a history and set of recommendations in accordance with the data found.

Another Study was published in the fall of 2012 to reflect new cases, new data and to further outline advantages and possible hindrances to the use of “green building” methods and/or materials on your projects.

BCCA member companies employ over 75 percent of the apprentices in the construction industry. The organization has a keen interest and strong history of supporting trades training, playing an active role in training issues on behalf of its member companies and continuing to promote and support future growth and development of the system.

This paper was commissioned to promote discussion with regard to the next evolution of the BC trades training system; of promoting an understanding of the core elements of the training system and their functions; and, to propose a series of next steps for moving forward.

The BCCA is interested in working collaboratively with government, industry, and other key participants to develop a multi-year plan for the future growth and development of the trades training system. This would include development of a future vision for the system; the development of strategic and operational plans; and identifying appropriate investment decisions for the trades training system.

If the trades training and apprenticeship system is to remain relevant to the needs of industry, employers, and the system at large, it must stay abreast of the times by adapting to new technologies, evolving business practices, and fluctuating economic activity. The paper makes two core assumptions: that the demand for skilled workers will continue to be strong in the future, and that the supply of skilled workers will diminish as a result of changing demographics.

The thesis presented in this paper suggests that if industry is to continue to have access to a pool of skilled workers going forward, the training system will need to adopt a more proactive approach to planning the future evolution of the training system than has been utilized in the past. It is also suggested that the training system will need to evolve towards a model which places greater emphasis on recruitment and retention, and a model which sustains the system’s training capacity and increases its ability to respond to changes in demand.

Be sure to subscribe to our monthly BCCA Briefing to get the latest on important topics like prompt payment and compulsory trades.