Inflationary Pressures in BC Construction Industry Contributing to Higher Costs and Uncertainty Province-Wide

Fall 2025 Stat Pack from BC Construction Association indicates outsized inflationary labour and material costs, double the average for the overall economy.

VICTORIA, BC (OCTOBER 28, 2025) – The BC Construction Association (BCCA) has released its Fall 2025 Stat Pack, a semi-annual report that examines leading economic and labour conditions across British Columbia’s construction sector. The latest data shows construction material costs have increased by four per cent year-over-year, which is double the Bank of Canada’s inflation target. These sustained cost increases are raising the overall cost of building at a time when trade uncertainty and other pressures continue to contribute to BC’s affordability challenges.

Even as costs rise, sector activity remains steady. Industrial, commercial, and institutional (ICI) permit values are up nine per cent year over year, and the number of multi-unit residential permits issued is up ten per cent.

“While overall inflation in BC and Canada has cooled, we continue to see construction material costs rise at a higher rate in BC’s construction sector,” said Chris Atchison, President, BCCA. “These pressures are driving construction costs higher at a time when trade uncertainty is already causing many to rethink their investments, creating a secondary impact across the industry.”

BC’s construction sector remains a key driver of the provincial economy, contributing 9.2% of GDP and employing over 267,000 people, demonstrating its strength and resilience. BCCA continues to support initiatives that encourage growth and investment across the sector.

The release of the Stat Pack comes as the provincial government has introduced Prompt Payment legislation. The legislation is designed to ensure workers and businesses are paid on time for completed work, bringing British Columbia in line with other provinces across Canada. BCCA has been a leading advocate on this issue and continues to champion the Bill’s passage.

“There are many external pressures on our industry that we cannot control, but advocating for prompt payment and fairness across our industry is something we can,” added Atchison. “We look forward to working with the government to advance this legislation and provide contractors with relief from the ongoing pressures created by trade and payment uncertainty.”

To check out the Fall 2025 BC Construction Industry Stat Pack, visit bccassn.com/2025FallStatPack.

Details regarding data sources can be found at bccassn.com/2025FallStatPackSources.

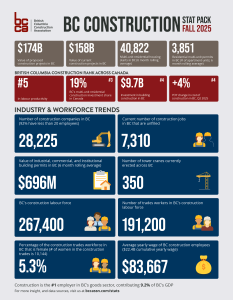

KEY BC CONSTRUCTION INDUSTRY STATISTICS

- Construction is the No. 1 employer in BC’s goods sector.

- BC’s construction industry accounts for 9.2% of the province’s total GDP, totalling $28.5 billion.

- 267,400 people rely directly on BC’s construction industry for a paycheque, an increase of 10% since last year.

- Number of workers in trades jobs: 191,200, up 14% since last year.

- The number of women in construction trades is 10,134 (5.3%), an increase of approximately 600 women over the past year.

- Number of construction companies in BC: 28,225, an increase of over 160 companies over the past year.

- The average yearly wage of BC construction employees is $83,667, an increase of 16% over the past year and 41% over the past 5 years.

- Current job vacancies in BC construction: 7,310, a decrease of 37% over the last year.

- The estimated value of proposed major construction projects in BC: $174B, an increase of 5% since last year, and a decrease of 21% over the past 5 years.

- The estimated value of current major construction projects underway in BC: $158B, a decrease of 7% since last year, and an increase of 41% over the past 5 years.

- Value of industrial, commercial, institutional building permits: $696 million (6-month rolling average), is up 9% compared to last year.

- Multi-unit residential permits (measured as the # of apartment units, on a 6-month rolling average): 3,851, up 10% compared to last year.

- Multi-unit residential construction starts (includes apartment and other unit types, on a 6-month rolling average): 40,822, an increase of 11% over the last year.

- BC’s rank in labour productivity across Canada is #5.

- Share of multi-unit residential construction investment across Canada is 19% and ranked #3.

- Estimated building investment in BC for Q2, 2025 was $9.7B, ranked #4 across Canada.

- Cost of construction in BC has increased by 4% since last year, ranked 4th highest across Canada.

- Number of tower cranes currently erected across BC is 350.

About: The British Columbia Construction Association (BCCA) is a non-partisan and non-profit organization, working with four Regional Construction Associations (NRCA, SICA, VICA, and VRCA) to serve more than 10,000 employers in the province’s industrial, commercial, institutional, and residential multi-unit (ICIR) construction industry regardless of labour affiliation. BCCA advocates on behalf of all employers to ensure British Columbia’s construction sector remains productive and resilient.

For more information about BCCA, visit: bccassn.com.

-30-

Media Contact

Sajjid Lakhani

sajjid@impactcanada.com

778-387-4647